Latin America’s Sweetener Market Emerges as Strategic Growth Avenue for Manufacturer in Health-Driven Food Reformulation

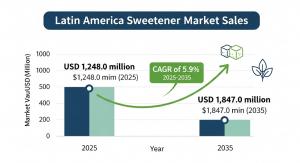

NEWARK, DE, UNITED STATES, August 6, 2025 /EINPresswire.com/ -- Latin America’s Sweetener Market is entering a transformative decade in the sweetener industry. As manufacturers seek to realign their product portfolios in response to evolving consumer demands, regulatory pressures, and rising health awareness, the sweetener market is projected to surge from USD 1,248.0 million in 2025 to USD 1,847.0 million by 2035, growing at a CAGR of 5.9% over the forecast period.

This steady market expansion offers a compelling growth path for manufacturers—especially those proactively innovating to reduce sugar, adopt clean-label strategies, and embrace consumer wellness trends.

Why Sweeteners Are Now a Manufacturer’s Strategic Imperative

Sugar reduction is no longer a trend; it’s a business-critical transformation. Health-conscious consumers across Brazil, Mexico, and the rest of Latin America are shifting their preferences toward natural, plant-based sweeteners. These include stevia, monk fruit, agave syrup, and allulose, which align with broader wellness movements and diets such as keto, low-carb, and diabetic-friendly lifestyles.

At the same time, artificial and sugar alcohol-based alternatives like aspartame, sucralose, xylitol, erythritol, and maltitol continue to play a crucial role in reformulating soft drinks, processed foods, and confectionery items—especially where taste and stability are paramount.

This dual demand—both for natural and functional synthetics—means manufacturers must become more agile in R&D, formulation, and sourcing strategies to meet diversified needs.

Application Opportunities: From Beverage to Personal Care

The market’s broad reach spans beverages, baked goods, dairy products, pharmaceuticals, and personal care—with food applications alone commanding a 53% market share in 2025.

The beverage segment—which includes soft drinks, energy drinks, and functional beverages—is undergoing rapid sugar reduction and clean-label reformulation. Meanwhile, the bakery and confectionery sector is seeing a notable surge in demand for sweetened yet sugar-free chocolates, candies, and baked snacks.

Even in pharmaceuticals, sweeteners like xylitol and sucralose are essential in making cough syrups and chewable tablets palatable. The oral care segment also benefits from sweeteners, especially xylitol, for its therapeutic use in toothpaste, gum, and mouthwash.

For manufacturers, this signals multi-sector demand with the potential to scale formulations across a diverse range of product categories.

Policy-Driven Change: Sugar Taxes Reshape Product Development

One of the defining external forces reshaping the Latin American sweetener market is government intervention. Countries like Mexico and Brazil have implemented sugar taxes and front-of-pack labeling regulations to combat obesity and diabetes.

These policies are actively shifting consumer choices and compelling food and beverage producers to reformulate products with low-calorie and sugar-free alternatives. In Mexico, for instance, sugar taxes have catalyzed significant product innovation, encouraging manufacturers to incorporate sucralose and stevia into mainstream SKUs.

For companies looking to gain regulatory resilience, sweetener integration is no longer optional—it is a competitive necessity.

Country-Specific Growth Hotspots

Brazil, accounting for 34% of the market, is the region’s dominant player. With a population increasingly educated about sugar-related health issues, demand for natural sweeteners is growing across all major food categories. The country’s strong agricultural base further supports local sourcing and innovation.

Mexico, with 26% market share, stands out due to its policy-driven demand surge. Sugar taxes and food labeling laws have forced reformulation, making Mexico a fertile ground for sweetener-based product expansion, particularly in beverages and snack foods.

These two markets, along with the 31% held by the rest of Latin America, present fertile ground for scalable, health-focused manufacturing strategies.

Natural Sweeteners Set to Capture 31% Market Share in 2025

By 2025, natural sweeteners will account for nearly one-third (31%) of the market, signaling a clear consumer preference for clean-label, plant-derived options.

Stevia, agave syrup, and monk fruit are gaining mainstream traction due to their low glycemic index, low calorie count, and alignment with sustainability goals. These sweeteners are no longer niche—they are becoming industry standards in reformulated food and drink products across Latin America.

Industry Landscape: Opportunity for Both Global Giants and Local Innovators

The market structure is moderately concentrated, with leading firms like Ingredion (19%), Cargill (16%), ADM (14%), and Tate & Lyle (11%) holding significant shares. However, regional players are carving out niche positions, especially in natural and organic sweeteners. Their proximity to raw materials such as stevia and agave gives them a competitive edge in localized, sustainable production.

For manufacturers, this landscape presents dual opportunities:

Global leaders can expand through M&A and strategic partnerships.

Emerging brands can scale with agility by tapping into niche dietary trends and leveraging regional supply chains.

Request Latin America Sweetener Market Draft Report -https://www.futuremarketinsights.com/reports/sample/rep-gb-22073

For more on their methodology and market coverage, visit https://www.futuremarketinsights.com/about-us.

Looking Ahead: What Manufacturers Must Prioritize

Invest in R&D for multi-sweetener blends tailored to local palates.

Monitor regulatory developments and be first to reformulate to meet new standards.

Explore cross-category applications—from beverages to personal care.

Build resilient, local supply chains for natural ingredients.

Enhance transparency and labeling to meet clean-label consumer expectations.

With a growing population, evolving dietary habits, and supportive regulatory shifts, Latin America is poised to become a global epicenter for sweetener innovation and application. For manufacturers, this market represents not just compliance—but a springboard for competitive advantage and future growth.

Explore FMI’s related ongoing Coverage in Food and Beverage Domain

Latin America Hydraulic Filtration Market:https://www.futuremarketinsights.com/reports/latin-america-hydraulic-filtration-market

Latin America Frozen Ready Meals Market:https://www.futuremarketinsights.com/reports/latin-america-frozen-ready-meals-market

Latin America Aqua Feed Additives Market:https://www.futuremarketinsights.com/reports/latin-america-aqua-feed-additives-market

These insights are especially valuable for stakeholders in packaging, pharmaceutical logistics, food and beverage, and therapeutic product innovation.

These insights offer valuable perspectives for packaging engineers, pharmaceutical supply chain experts, and personal care product manufacturers looking to align with emerging trends in cold-based product solutions.

Editor’s Note:

This press release draws from the Latin America Sweetener Market Outlook 2025 to 2035, which projects the market to grow from USD 1,248.0 million in 2025 to USD 1,847.0 million by 2035 at a CAGR of 5.9%. It highlights key trends in consumer health preferences, regulatory pressures, application opportunities, and country-specific insights, with a focus on supporting manufacturers' strategic decision-making and growth planning.

Rahul Singh

Future Market Insights Inc.

+1 347-918-3531

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.